KUALA LUMPUR, March 6 (Xinhua) -- Moody's Investors Service said on Wednesday that most Malaysian banks reported improvements in asset quality and capitalization last year, although their profitability was mixed.

The rating agency said in a report that the impaired loan ratios of most Malaysian banks fell at the end of 2018 year-on-year, because of the slower formation of new impaired loans at home and overseas, loan repayments and write-offs.

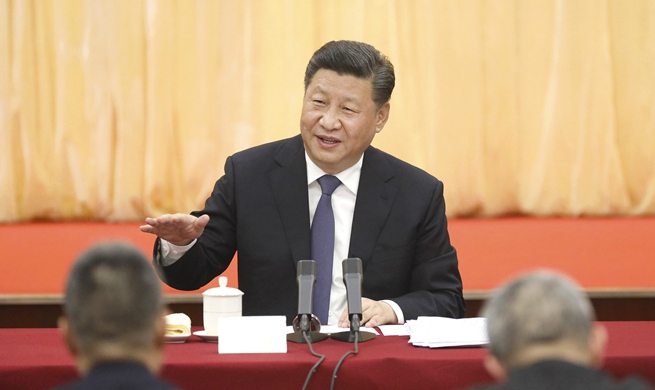

"In 2019, the banks' asset risks will rise as business conditions deteriorate for export-oriented sectors. Profitability will also fall as revenue growth slows and credit costs rise," Simon Chen, a Moody's Vice President and Senior Analyst said.

Nevertheless, he believed the banks' capital buffers will further improve due to slower asset growth, thereby helping the banks withstand the higher asset risks.

According to the report, Malaysian banks system-wide loan growth grew to 5.6 percent in 2018 from 4.1 percent in 2017, because of a gradual recovery in loan demand among corporates and households, partially as a consequence of the removal of a goods and services tax.

However, the loan growth rate will fall back to about 4 percent to 5 percent in 2019, as slower economic growth and uncertainty around the government's longer-term policy stance suppress loan demand among businesses and households, the report said.